The Appraiser

Appraiser Defined

Most people think an appraisal begins and ends with a number, but value is only one outcome of the inspection. The process is Standard 1 driven, starting with a field inspection where we build reliable data that does not exist until we create it. We are trained to see what others miss such as easements, zoning conflicts, septic and well placement, external influences, unpermitted additions, and condition issues hidden beneath cosmetic updates. These findings often determine whether a transaction succeeds or fails. Deals rarely collapse because of a low value. More often they fail because of undiscovered risks revealed during the appraisal.

The skill required to understand and apply effective age and depreciation takes years of experience to develop. No data collector can replicate that judgment and no algorithm can duplicate it. The reality is simple, this is a mic drop moment. To dismiss it is to increase the risk on every loan product, a risk that could have been avoided by relying on an appraiser’s expertise.

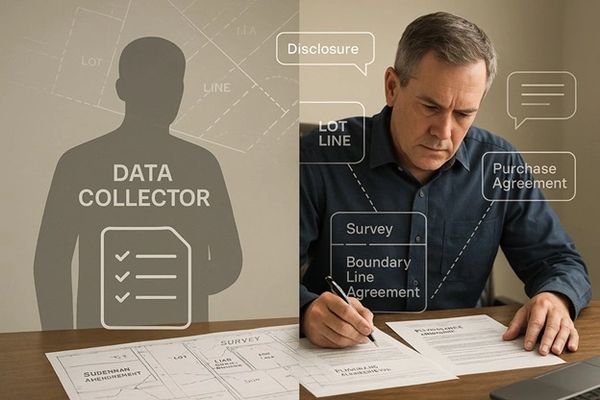

We are not data collectors. A data collector records what is obvious. We interpret, verify, and place each characteristic into the market context. We bring professional judgment, standards, and independence to the process, ensuring the property is understood rather than just described. Harbor strengthens this role by preserving our independence while providing modern tools that capture our findings as part of the national housing record. In this way, appraisers remain the profession trained to see what others do not, protecting lenders, borrowers, and communities alike.

You cannot send someone into a dwelling and expect them to walk out with an understanding of the property. It takes training to recognize what matters and to understand the significance of what is found. Parties do not always provide full disclosure, and important details are sometimes hidden from the appraiser. An appraiser’s expertise is in turning observation into reliable analysis, separating fact from assumption, and uncovering risks that could otherwise go unnoticed. This is why the appraisal profession remains essential, and why Harbor is committed to strengthening rather than replacing our role.

Every appraisal waiver issued mirrors the careless no-doc loans of 2004 to 2007. Calling a waiver a cost savings is rooted in ignorance, and branding it as modernization will not withstand the scrutiny of the next sharp housing recession. Legislative efforts such as S-1635 reveal a troubling shift away from independent valuation toward measures that reduce safeguards and increase systemic risk.

Why Appraisers Matter

Much of our work occurs after the inspection in Standard 2. We verify legal descriptions, compare parcels to plats and survey maps, and analyze the full purchase and sale agreement. In many files we receive a shortened contract that omits addenda or contingencies, so we reconstruct the complete terms to determine whether the parties are fully informed. We also test for proposed changes that are not yet recorded, including lot line adjustments, boundary line agreements, or surveys in progress.

A contemplated change may not be legally effective, may shift access or utilities, or may create encroachments. There may also be roadway maintenance agreements that were never carried out through the years and now require attention to bring the property into compliance. Our job is to catch these conditions, determine their status, and explain the risk so lenders and investors understand the property as it exists today.

We often encounter situations where title records are incomplete or incorrect, and it falls to the appraiser to identify and clarify those errors. Oceanfront properties provide a clear example, where ownership lines shift over time due to accretion or erosion, and the true boundaries may trace back to historical court decisions made decades earlier. In many markets shoreline management acts and laws add another layer of complexity, as property may or may not extend into the body of water depending on jurisdiction. Property owners themselves sometimes misunderstand these boundaries and make claims that do not hold up when tested against the facts. Delineated wetlands can present yet another trap, with restrictions that directly affect utility and value. It is critical that these points be analyzed correctly, and this cannot be accomplished by sending a data collector to align with an automated valuation number. To reduce the process to that level is to invite unnecessary risk in the name of saving money on an appraisal fee.

The appraisal profession carries decades of accumulated knowledge and expertise that cannot be replicated by shortcuts or delegated to lower-level substitutes. If the purpose of modernization is to mitigate risk, it is difficult to see how anyone could believe that a data collector and an automated model provide the answer. Risk is uncovered through trained judgment, experience, and the ability to test information against facts that are often complex and hidden from the appraiser. To believe that an appraiser can be replaced is to misunderstand entirely what an appraiser is and what we do. Our role is not simply to assign a value but to apply skill, judgment, and experience in protecting the integrity of every transaction. This is why the profession remains indispensable and why Harbor is committed to ensuring the work of appraisers is respected, supported, and carried forward into the future.

Appraiser Toolbox

Through strategic alignment with OpenAI, Harbor gains access to a level of engineering and AI design previously unavailable to the housing sector. These aren’t off-the-shelf solutions, they’re purpose-built tools forged through direct collaboration with one of the world’s leading AI research labs. Whether it’s natural language processing for real-time field data capture, vision systems that detect risk factors invisible to the naked eye, or predictive models that evolve with the market, Harbor integrates these technologies at the core of its daily operations. Every device, every data stream, and every insight is enhanced by cutting-edge AI designed for one mission: total housing system oversight. Harbor will unveil never before seen inspection tools.

This partnership does more than supply tools—it fuels a continuous development cycle. Harbor’s work in the field directly shapes how new property inspection tools and systems are built, refined, and deployed. From name-blind algorithms and privacy-first architecture to ethical AI enforcement and explainable outputs, the systems in use today are already preparing for tomorrow.

The program will begin with the standard tools carried by appraisers today and progress into improved tools when available.

PADS Uplink

The PADS Uplink is the real-time heartbeat of the Harbor system, quietly transmitting thousands of verified data points from field agents across the country to Harbor’s central intelligence hub in Utah. This uplink serves as a vital connection between on-the-ground property inspection tools and national housing oversight, ensuring that every measurement, observation, and structural risk is instantly processed, encrypted, and absorbed into the system. Whether captured in a rural dead zone or an urban corridor, field data capture flows through secure uplink channels, syncing on demand via vehicle-based hubs, satellite relays, or high-bandwidth connections.

What makes the PADS Uplink revolutionary isn’t just its speed, it’s the intelligence behind the stream. Each transmission is sorted, categorized, and benchmarked against national norms in real time. The Harbor HQ in Utah doesn’t just receive data, it learns from it, enhancing the accuracy of real estate appraisals. Regional anomalies are flagged, environmental shifts are tracked, and risk indicators are fed directly into the Pulse Brief. The uplink is the quiet backbone of Harbor’s vigilance, allowing a decentralized force of field agents to feed one unified system with clarity, continuity, and control.

PADS Sync Event

When the PADS Uplink transmits field data capture from the field, Utah’s backend infrastructure immediately begins a multi-layered process of authentication, decryption, and mapping. Each transmission includes a digital signature, timestamp, GPS reference, and inspection hash, ensuring that what arrives in Utah is verifiably linked to a specific property inspection event. Utah’s AI parsing engine reads metadata from every image, cross-references floor plan overlays, and flags anomalies in sequence or location. Redundant file storage is automatically triggered, and a real-time validation thread begins populating the PADS report shell for real estate appraisals. Within seconds, structured data begins snapping into place, photos align with rooms, sketches tag to measurements, and timestamps create a chronological event chain for the appraiser’s review. The system is designed to prioritize speed, integrity, and auditability, without requiring the appraiser to do anything beyond completing the inspection.

Appraiser Desk

Once the inspection is complete, the appraiser uploads field data through the Property Appraisal Delivery System (PADS) in Utah. When the appraiser opens Harbor back at the office, Appraiser Desk becomes the command center, with images, sketches, field notes, and measurements already in place, organized and ready for review, cutting hours and even days off the traditional report preparation process.

The appraiser gains access to real-time neighborhood value trends through the Harbor Intelligence Grid. This live data stream highlights market movements, comparable sales activity, and emerging patterns, giving the appraiser a clearer view of local conditions while preparing the report.

Every appraiser certified by Harbor is assigned a secure digital fingerprint, allowing their contributions to be recorded and verified without public disclosure. This ensures accountability, preserves professional integrity, and maintains a clear chain of custody for every valuation while keeping the final certified value under Harbor’s authority.

The certified value issued through Harbor often matches the appraiser’s conclusion, reflecting a shared analysis of the property’s market position. In other cases, Harbor’s integrated intelligence systems, drawing from risk models, market trend monitoring, and real-time data sources, may indicate a deviation. This process is designed to strengthen the accuracy and reliability of the valuation, not to override the appraiser’s expertise, ensuring that both perspectives work in concert to protect the integrity of the transaction.

This one-page certification, referred to as a system-wide intelligence statement, delivers a clear, authoritative record of the property’s value at a specific moment in time. Backed by Harbor’s continuous market monitoring, it provides a dynamic reference point that evolves with the housing market, offering lenders and stakeholders a single, trusted benchmark that is both grounded in professional appraisal work and supported by advanced analytical oversight.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.