Funding

🟦 Baseline Spending

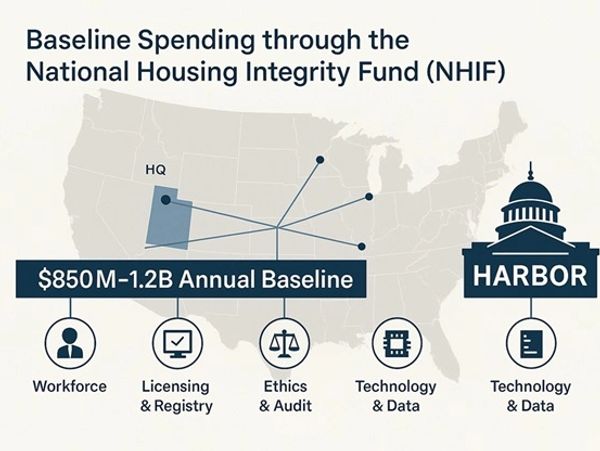

The Harbor system is anchored by the National Housing Integrity Fund (NHIF), a federally authorized budget line that ensures operational stability, regulatory independence, and institutional transparency. This baseline funding supports every core function required to run Harbor’s federal licensing platform, oversight mechanisms, and ethical governance systems.

From Harbor’s headquarters in Utah to its network of regional offices, NHIF sustains the salaries of more than 3,500 federal employees and funds the critical infrastructure that makes the system function. This includes the national licensing registry, internal audit courts, and the ethical firewall that guarantees separation between valuation and transaction. NHIF also supports Harbor’s secure data architecture, including contractual partnerships with key vendors such as OpenAI and national MLS networks, while powering public-facing portals and interagency compliance tools.

Unlike legacy nonprofit pass-throughs, NHIF is a direct and transparent funding model. It replaces the fragmented financial channels once routed through the Appraisal Subcommittee (ASC) and The Appraisal Foundation (TAF), offering a modern, centralized solution that is purpose-built for today’s regulatory demands.

🟦 The Launch

Harbor was launched with a one-time federal investment of $6 billion, not as a temporary fix, but as a foundational blueprint for a completely new national oversight system. This wasn’t an attempt to patch the holes in a crumbling structure; it was a ground-up build of a modern, federally backed solution designed to outlast outdated institutions and withstand the demands of a rapidly evolving housing economy.

That initial investment gave rise to a powerful framework: the Harbor Intelligence Grid (HIG), a centralized federal licensing system, ethics firewall courts, and regional “Go Teams” equipped to respond in real time to market disruption and disaster events. It also funded the creation of public education campaigns, compliance portals for all housing stakeholders, and the formal sunset of legacy systems like ASC and TAF.

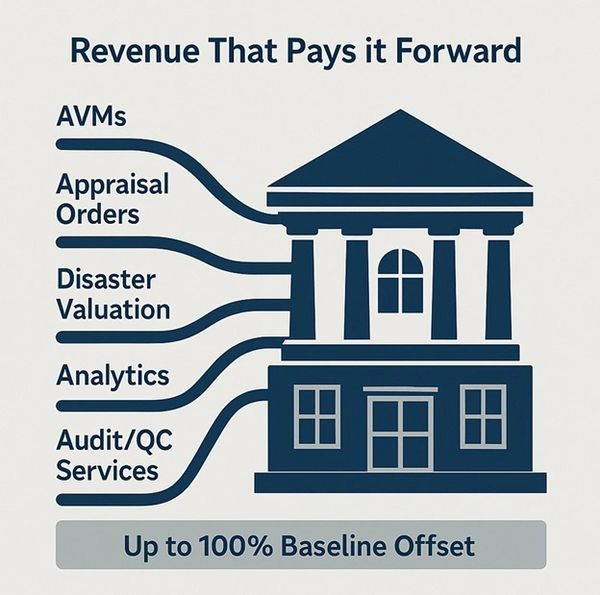

Following its launch, Harbor transitions to a sustainable annual operating model with baseline spending estimated between $850 million and $1.2 billion. This budget supports all federal staff, district offices, compliance operations, AI-powered data analysis, and vendor partnerships. Crucially, Harbor is not fully reliant on taxpayer dollars. A significant portion of this operating cost is offset by internal revenue streams, appraisal services, AVM licensing, housing analytics, and disaster valuation contracts, ensuring that Harbor remains fiscally resilient well into the future.

Harbor wasn’t born from compromise. It was built to last, federally, transparently, and with a mission that refuses to bend to legacy interests.

🟦 The Engine

Harbor was designed to earn, not profit. Its income isn’t driven by markets or shareholders, but by the operational needs of a national housing oversight system. Every dollar earned helps reduce the burden on federal baseline spending, pushing Harbor closer to fiscal independence without sacrificing public trust or professional integrity.

The system generates revenue through appraisal routing, AVM licensing, and a range of federal services that directly support housing stability and policy enforcement. Harbor provides appraisal and underwriting infrastructure for lenders, disaster-response valuation contracts for FEMA and HUD, and quality-control services for agencies like the IRS, SBA, and VA. It also delivers real-time housing intelligence through risk dashboards and Pulse Briefs used by regulatory bodies across the country.

These services are not private-sector ventures. They are public utilities, engineered to serve the public interest and to fund smarter, more ethical government operations. Annual revenue is projected at approximately $1.65 billion, driven by federally routed appraisal activity and carefully licensed AVM usage. Harbor’s AVMs are limited by design: they operate only at controlled decision points in the loan process, under strict licensing agreements, and with full transparency and auditability.

By placing both AVMs and human appraisals within the same ethical system, Harbor restores balance to valuation. Appraisers are not displaced, they are protected. Technology is not misused, it is aligned. In this structure, revenue becomes a stabilizing force, ensuring that the housing market is served by a system built for fairness, clarity, and lasting trust.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.