Primary Launch Capital

A Rare One-Time Opportunity

The federal government’s planned sale of its Fannie Mae (FNMA) stock holdings, as part of the company’s wind-down, creates a rare window for decisive housing reform. These shares, acquired and held through years of federal conservatorship, now represent a significant asset that can be converted into long-term public benefit.

By dedicating a portion of the FNMA stock sale proceeds to Harbor’s launch, the nation can seize this moment to modernize its housing valuation and oversight systems without raising taxes or adding to the national debt. This approach transforms a one-time financial transaction into a lasting investment in market stability and consumer protection.

The opportunity is both timely and strategic. FNMA’s wind-down is already a matter of federal policy discussion, meaning the mechanism for asset sale is in motion. By linking Harbor’s funding directly to this process, we ensure that the proceeds from Fannie Mae’s past federal support are reinvested into safeguarding the housing market’s future.

Turning Asset Sales into Housing Reform

The FNMA stock sale offers more than just a fiscal windfall, it is a chance to convert a single asset transaction into a nationwide housing stability initiative. By directing a portion of the sale proceeds into Harbor, the federal government can transform the privatization of Fannie Mae into a visible and lasting public good.

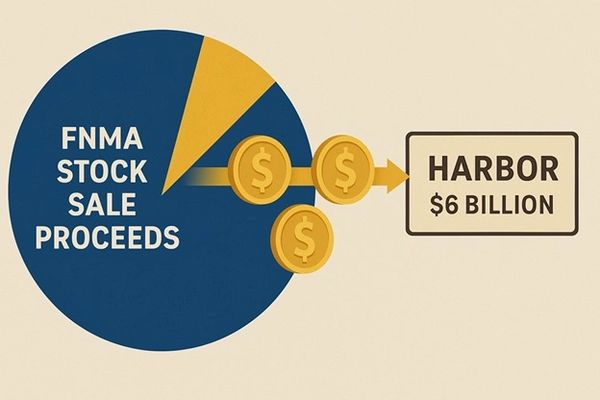

Harbor’s Year One launch requires $6 billion. Even a small percentage of the projected FNMA sale value could fully cover these costs, eliminating delays tied to incremental funding sources. This ensures the system is operational within months, not years, bringing immediate oversight improvements and market protections.

This approach builds a direct connection between the end of FNMA’s federal stewardship and the beginning of a new, modern oversight framework. Instead of allowing the sale proceeds to disappear into general revenue, earmarking them for Harbor ensures that the legacy of federal intervention in Fannie Mae is one of reform, accountability, and strengthened consumer protection.

Immediate Readiness, Long-Term Stability

Harbor is not an early-stage idea , it is a fully designed, costed, and operationally mapped system that has been engineered for rapid deployment. Every operational branch, from the federal licensing division to the AI-driven housing intelligence grid, has been defined in detail. This means that once funding from the FNMA stock sale is secured, the system can transition from pre-launch to nationwide operation in months, not years.

On day one, Harbor begins delivering measurable improvements: a fully federal licensing and oversight division replacing fragmented state-level enforcement, an ethical firewall to protect consumer data, and a housing intelligence network capable of detecting market shifts before they spiral into crisis. These capabilities close the oversight gaps that have plagued the housing market for decades.

Harbor also operates under a streamlined 20:1 regulation ratio , for every new regulation introduced, twenty outdated or redundant ones are removed. This ensures a continuously modernized rulebook, cutting bureaucratic waste while improving clarity for lenders, appraisers, and regulators. This model echoes successful deregulation principles used in other sectors, but applies them with a housing-market-specific focus to increase efficiency without sacrificing oversight.

The benefits are not short-lived. By integrating housing oversight, valuation reform, and market intelligence into a single national system, Harbor reduces the severity of boom-bust cycles and strengthens long-term stability in the U.S. housing market. This is not a temporary policy experiment, it is a permanent safeguard, designed to adapt to changing economic and market conditions without becoming bloated or obsolete.

Funding Harbor through the FNMA stock sale ensures that the final chapter of federal intervention in Fannie Mae’s history is one of progress, accountability, and lasting reform. Instead of allowing these proceeds to dissolve into general revenue, this strategy captures their value to build a future-proof housing oversight system that protects consumers, supports fair market conditions, and preserves confidence in the nation’s most important asset, its homes.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.